—How Global Brands Leverage Asian Manufacturing Advantages, with WELLDONE Empowering Precise Brand Layout

Industry Trends: Surging Global Demand for Hygiene Product OEMs, Asian Supply Chains as Core Engines

With changing global demographics, rising health awareness, and consumption upgrades, the hygiene products market continues to expand. According to Statista, the global feminine hygiene products market is projected to exceed $52 billion in 2024, while baby diapers and adult incontinence care categories grow at annual rates of over 6%. Against this backdrop, brands increasingly demand efficient, flexible, and cost-effective OEM production. Asian supply chains have become the top choice for global brands, driven by three key advantages:

-

Industrial Cluster Effects:

Hygiene product clusters centered in Jinjiang (China), Osaka (Japan), and Ho Chi Minh City (Vietnam) integrate raw materials, equipment, and finished product production, significantly reducing costs and delivery cycles.

-

Technological Innovation:

Asian manufacturers invest heavily in R&D, leading innovations such as ultra-thin core technology and plant-based biodegradable materials—surpassing traditional European and American counterparts.

-

Policy and Trade Dividends:

The deepening implementation of RCEP (Regional Comprehensive Economic Partnership) eliminates tariff barriers and streamlines logistics across Asia, accelerating cross-border supply chain collaboration.

OEM competition pattern: from "cost depression" to "value highland", professional barriers determine the outcome

While Asia hosts numerous OEM enterprises, global brands now prioritize "full-chain service capabilities" over low prices. Key evaluation criteria include:

Vertical Integration: Can the partner achieve autonomous control from raw material supply, equipment calibration to final product delivery?

Compliance and Certifications: Does the factory hold FDA, CE, ISO 13485, and other international certifications? Can it meet regulations like the EU Single-Use Plastics Directive (SUP)?

Customization Agility: Can it support small-batch trials, differentiated designs (e.g., sensitive-skin sanitary pads, extra-long night-time products), and flexible peak-season capacity adjustments?

Jinjiang-based leading companies, such as WELLDONE, leverage a "raw materials + equipment + OEM" trinity model, reducing product development cycles by over 40% and raw material waste to 60% below industry averages.

Brand Challenges and Solutions: How to Choose the Right OEM Partner?

Through collaborations with hundreds of global brands, WELLDONE identifies critical decision factors:

-

Core Raw Material Autonomy:

Key materials like SAP (superabsorbent polymer) and breathable backsheets directly impact product quality. Factories with in-house R&D capabilities (e.g., WELLDONE’s SAP composite core technology) help brands differentiate.

-

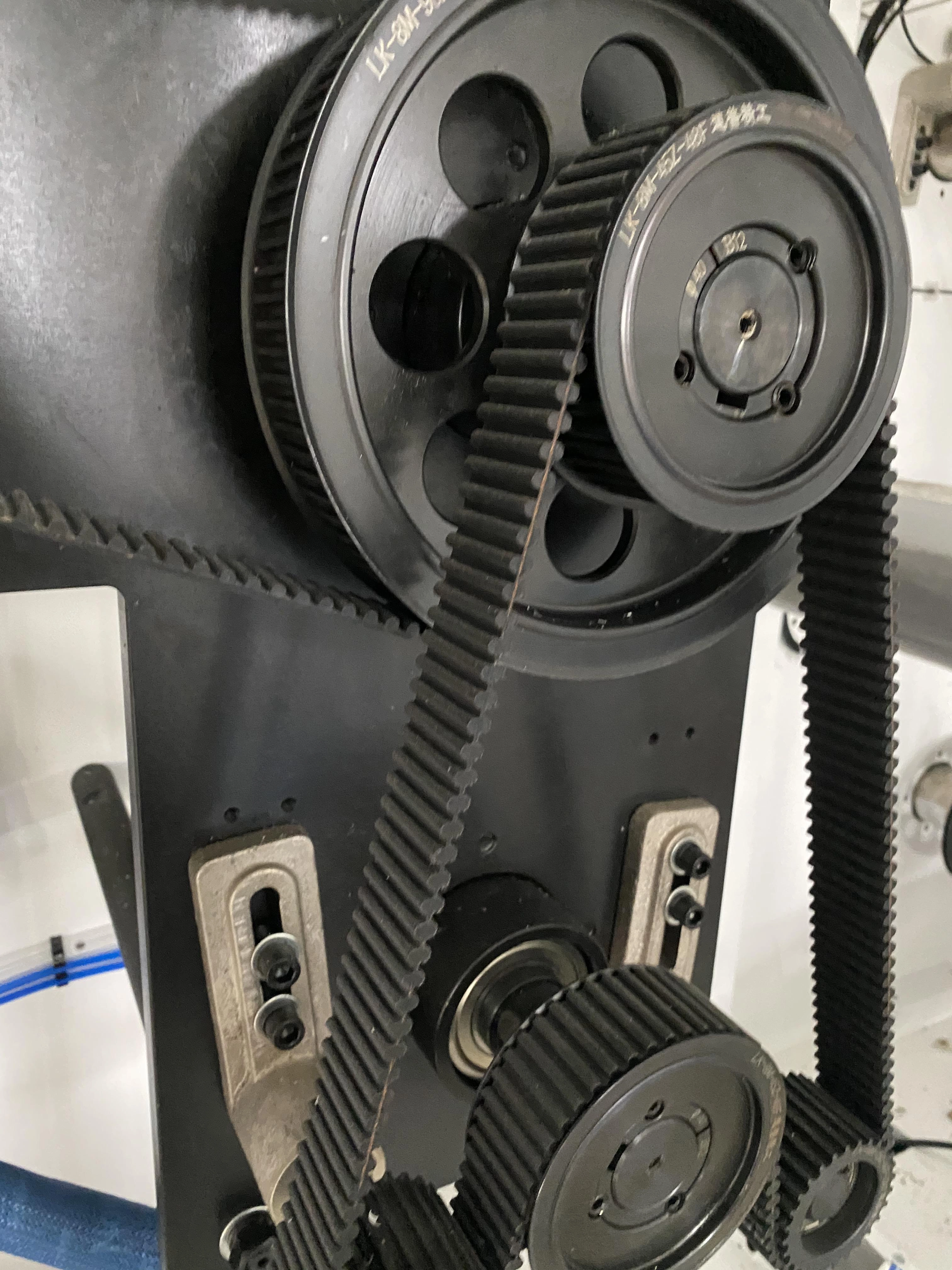

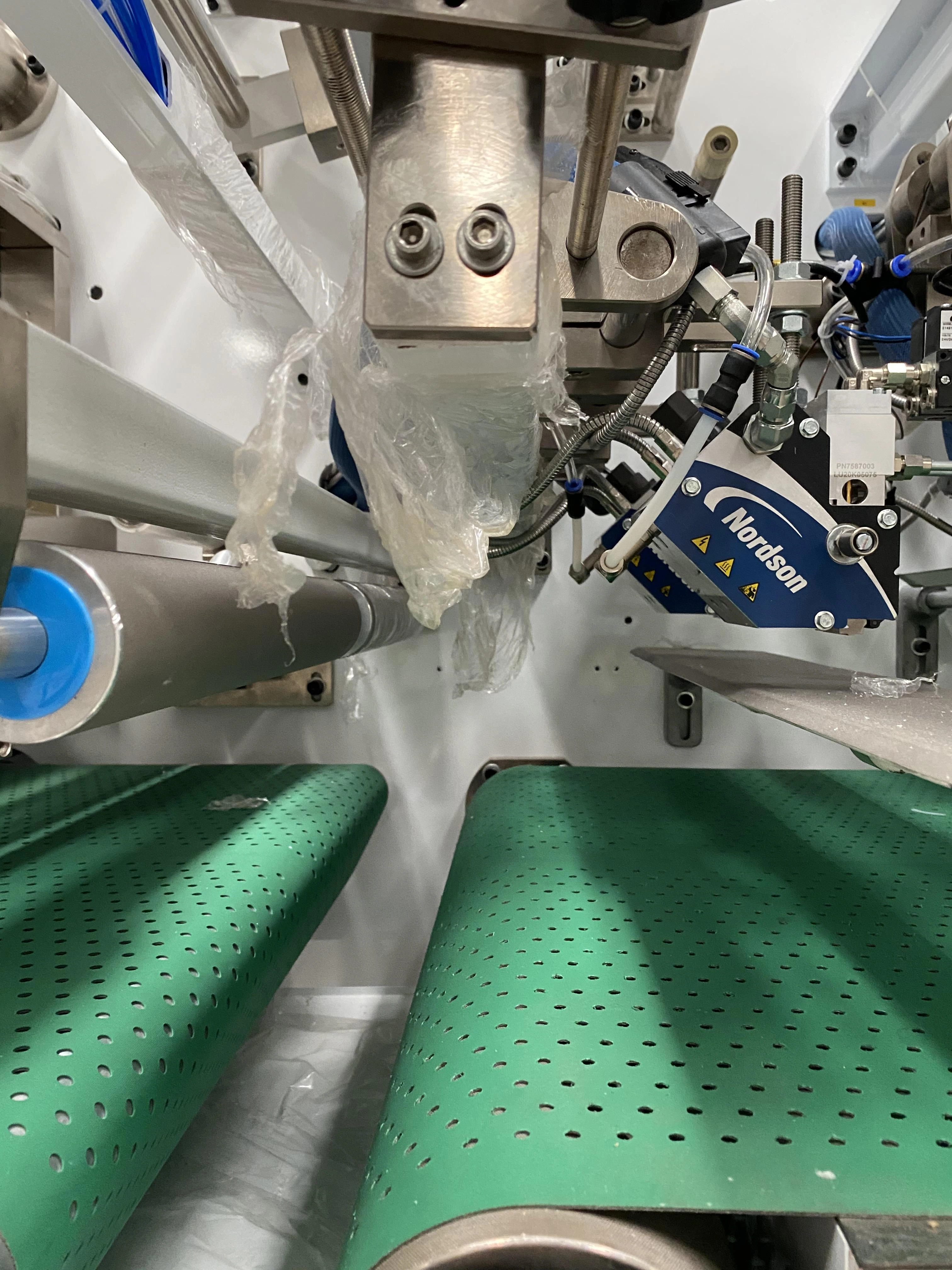

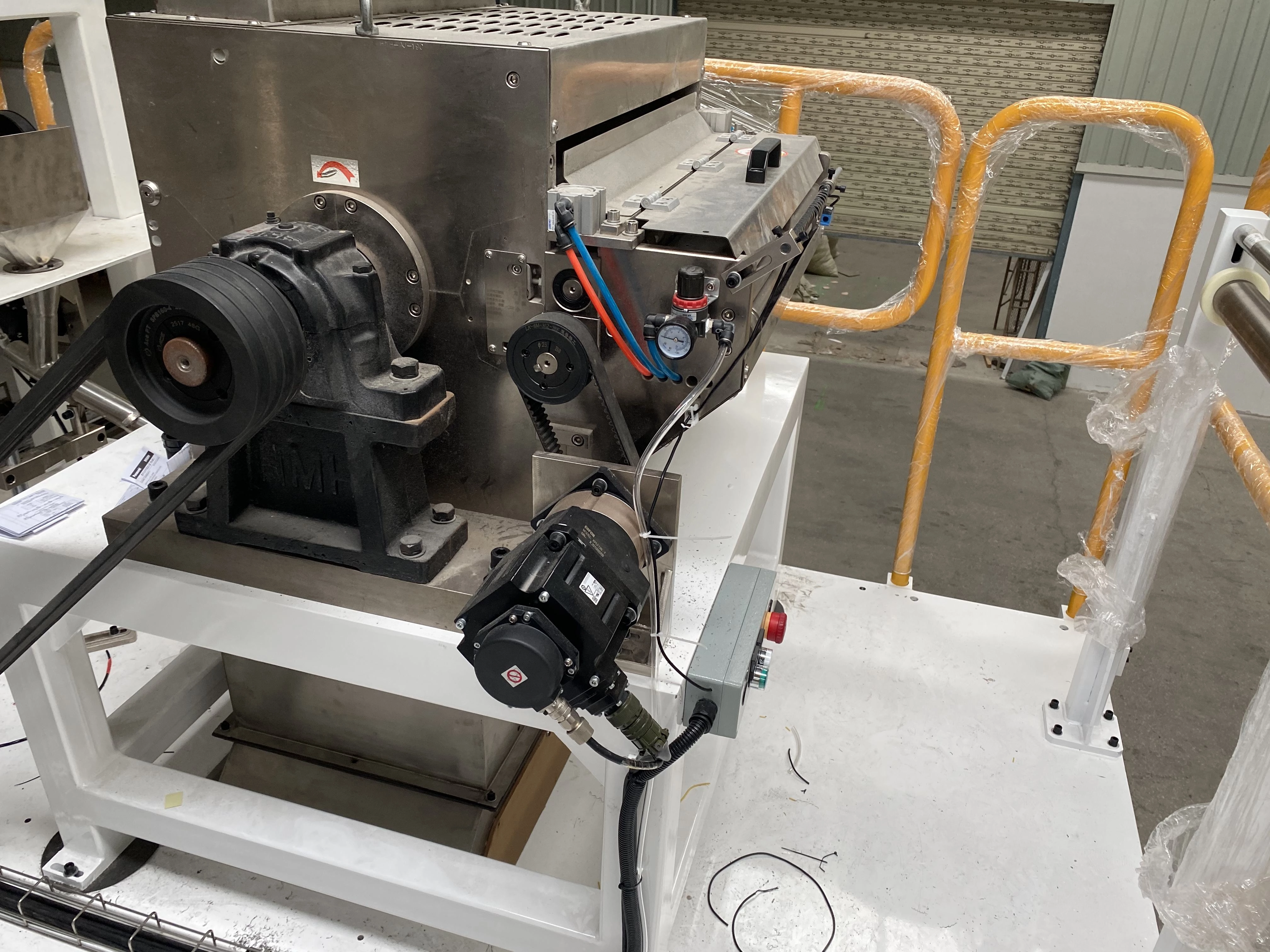

Equipment and Process Alignment:

High-speed lines (800-1200 pieces/minute) suit mass-market standard products, while modular equipment caters to niche functional items. WELLDONE’s "asset-light rapid response model" (link: WELLDONE Solutions Page) supports full design-to-production cycles in 30 days.

-

Sustainability Compliance:

Stringent EU and North American requirements for recyclable packaging and carbon footprint tracking. Pioneers like WELLDONE have invested in biodegradable material lines and offer carbon accounting reports to pass ESG audits.

WELLDONE Case Study: 15 Years of Technical Accumulation Empowering Global Brands

As a benchmark enterprise in Jinjiang’s hygiene cluster, WELLDONE partners with Unilever, Japan’s Unicharm, and others through its "raw materials + machinery + OEM" full-chain service. Core strengths include:

- Technical Leadership: Proprietary "instant absorption anti-leakage" core structure balances high absorbency with ultra-thin design.

- Cost Efficiency: Proximity to Fujian petrochemical bases reduces SAP resin costs by 15% below industry averages.

- Global Compliance: FDA, CE, and FSC certifications enable exports to 50+ markets including Europe, Southeast Asia, and the Middle East.

- Agile Delivery: 100,000-class cleanrooms and 24-hour prototyping teams support flexible OEM/ODM collaboration.

2024 Outlook: The OEM Industry Moves Toward "Deep Globalization + Localization"

In the future, leading OEM companies need to build moats in two aspects:

- Regional Capacity Layout: Establishing factories in Southeast Asia, Mexico, etc., to mitigate geopolitical risks and proximity to end markets.

- Digital Collaboration: Real-time data integration via ERP/MES systems (aligned with the company’s current lightweight tech positioning).

- Conclusion: Partner with WELLDONE to Seize Global Market Opportunities

Choosing an OEM is fundamentally selecting a "supply chain strategic partner." With 15 years of technological accumulation and full industry chain layout, WELLDONE is committed to becoming a "behind-the-scenes enabler" for brands - from raw material innovation to cost reduction and efficiency improvement, from compliance overseas expansion to the creation of explosive products, providing partners with a certain growth path.

Visit WELLDONE’s official website today to download the 2024 OEM Collaboration White Paper and unlock tailored solutions for efficient partnerships!

WELLDONE is one of the leading companies, which is focused on supplying A-Z Service for the customer in the disposable hygiene product field, which located in Jinjiang City, Fujian Province, China.

WELLDONE is one of the leading companies, which is focused on supplying A-Z Service for the customer in the disposable hygiene product field, which located in Jinjiang City, Fujian Province, China.